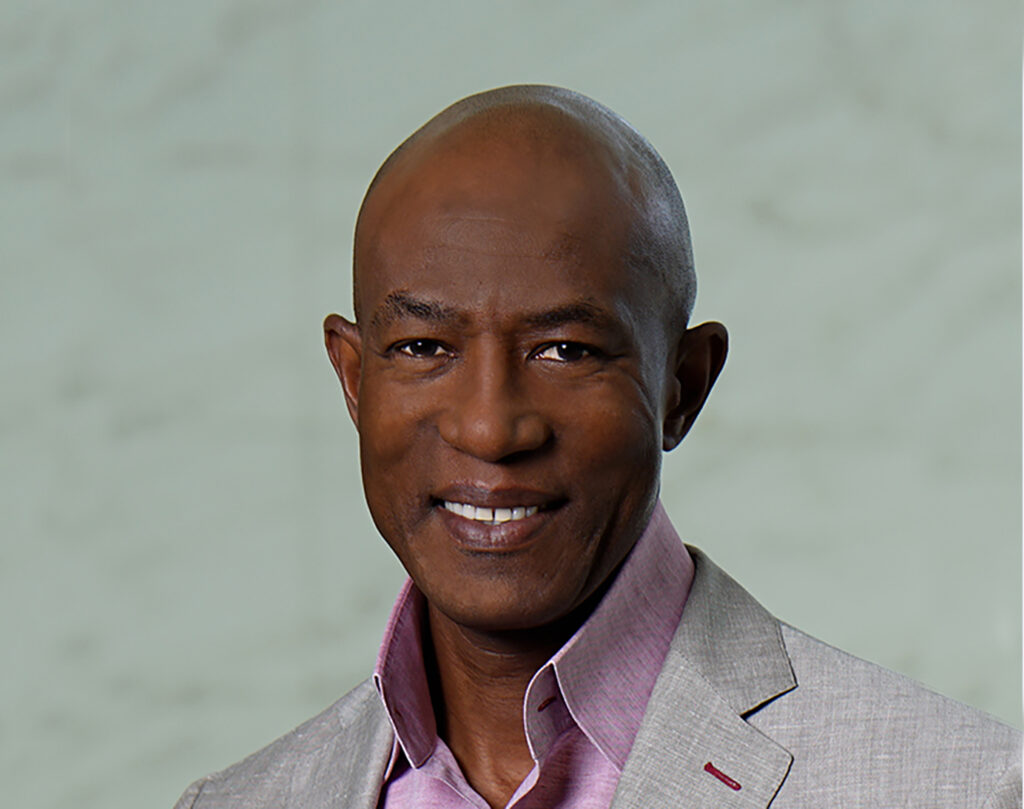

Grady Crosby, Vice President, Chief Sustainability and Impact Officer, Northwestern Mutual

Financial freedom and racial equity are deeply intertwined. Data surrounding Black Americans shows that despite gains in education and earnings, the racial wealth gap remains staggering. According to the Federal Reserve Board, Black Americans’ net worth is 70% below that of non-Black households.

“Reversing systemic inequity requires a systemic commitment supporting business, education and communities,” says Northwestern Mutual’s Vice President, Chief Sustainability and Impact Officer Grady Crosby. “I’ve found a visible, tangible, organizational commitment – from the top, through the middle, and all the way down to the fundamental core of our business – is critical for diversity, equity, inclusion and belonging to thrive and add long-term value within an organization. It must be made a strategically integrated business imperative. When that happens, it emboldens employees to innovate and create opportunities that advance the objectives of social and business impact and value creation.”

Building on the success of its long-established Diversity & Inclusion Roadmap, as well as its decades-long community-centric philanthropic work, Northwestern Mutual developed its Sustained Action for Racial Equity (SARE) initiative. Launched in 2020 and led by Chairman, President and CEO John Schlifske, SARE is focused on creating bold, long-term impact that drives equity and inclusion in Black and African-American communities.

Northwestern Mutual is investing in the economic engine of Black business and driving conversations around financial literacy and inclusion.

Investing in Black entrepreneurs

Black entrepreneurs collectively receive less than 2 percent of venture capital investments. To address this gap, Northwestern Mutual carved out a $20 million investment through its venture capital fund, Northwestern Mutual Future Ventures.

Abim Kolawole, Vice President – Chief Audit Executive and SARE Executive Sponsor, Northwestern Mutual

“Capital is critical, but we also wanted to do more than just write a check,” says Abim Kolawole, Vice President– Chief Audit Executive and SARE Executive Sponsor. “So we created the Northwestern Mutual Black Founder Accelerator® which includes an investment of $100,000 that each selected entrepreneur is eligible to receive coupled with a comprehensive 12-week business training program, mentorship, access to venture capital partners and more. Program participants have gone on to accelerate their business plans, raise additional funding and spark both community and business growth.”

As part of this larger focus, in 2021 Northwestern Mutual established the $100 million Impact Investing Fund which directs investments to Black communities. It works to get capital to promising Black entrepreneurs, including a sizeable commitment within Northwestern Mutual’s hometown of Milwaukee.

In addition, Northwestern Mutual is elevating its supplier diversity program by expanding contracts with Black-owned suppliers to more than $10 million – just the beginning of an intentional effort to add resiliency to its supply chain.

Extending financial inclusion through community connections

Northwestern Mutual works to ensure all Americans can be free from financial anxiety and live their best lives by choice. To that end, the company is taking bold steps in underrepresented communities to enhance financial knowledge and build wealth. Additionally, partnerships with the National Urban League,

National Black MBA Association, AfroTech and others ensure Northwestern Mutual is using the power of connection and collaboration to drive change.

Kamilah Williams-Kemp, Executive Vice President and Chief Insurance Officer, Northwestern Mutual

“You will never build trust with a marketing campaign,” says Kamilah Williams-Kemp, executive vice president and chief insurance officer, and SARE task force member. “We want to authentically come to the table to learn and share what we know about building generational wealth. My grandparents were entrepreneurs who became ill and lost everything. Their story could have been different with financial knowledge and access, which literally changes families for generations. We are committed to facilitating conversations and action.”

Embracing the long-term view with a focus on business, education, partnerships, community, and inclusion is essential to building sustained success and helping close the racial wealth gap. “We’re proud of the progress we’ve made,” says Crosby, “and know there is much more to be done.”

To learn more, read Northwestern Mutual’s 2022 Sustainability Report.